Solana (SOL) has grown 28.4% over the past month, but its momentum has slowed down. After a brief mention of $184, it has earned just 0.78% over the past seven days. Nevertheless, Solana continues to dominate Dex metrics, leading all chains by $27.9 billion each week.

The broader ecosystem is still active, with multiple Solana-based apps among the best pricing generators. However, technical indicators such as RSI, Ichimoku Cloud and EMA lines suggest that the rally may lose steam and that the duration of potential integration or revisions may be ahead.

Solana leads the Dex market with a volume of $27.9 billion per week and Surging App activity

Solana continues to insist on controlling the Decentralized Exchange (DEX) ecosystem, leading all chains of trading volume for four consecutive weeks.

In the last seven days alone, Solana has recorded $27.9 billion in Dex volumes that take over the range of BNB chains, Ethereum, bases and arbitrum.

Solana’s weekly Dex volume surged by 45.78%, showing a strong revival of activity in the chain after declining activity between March and April.

This rise is a spike, part of a broader trend, consistently surpassing the $20 billion mark over the past month.

Adding to that momentum, Solana is home to four of four of the 10 best rate-generating apps and chains of last week. This includes familiar platforms and newcomers, demonstrating healthy diversity in the ecosystem.

The newly launched Solana-based launchpad, Belief App, has stood out in the recent surge. The last 24 hours alone have generated $3.68 million fees tolerate established platforms such as Pancakeswap, Uniswap, and Tron.

When the indicator changes to neutral, the momentum of the SOL is cooled

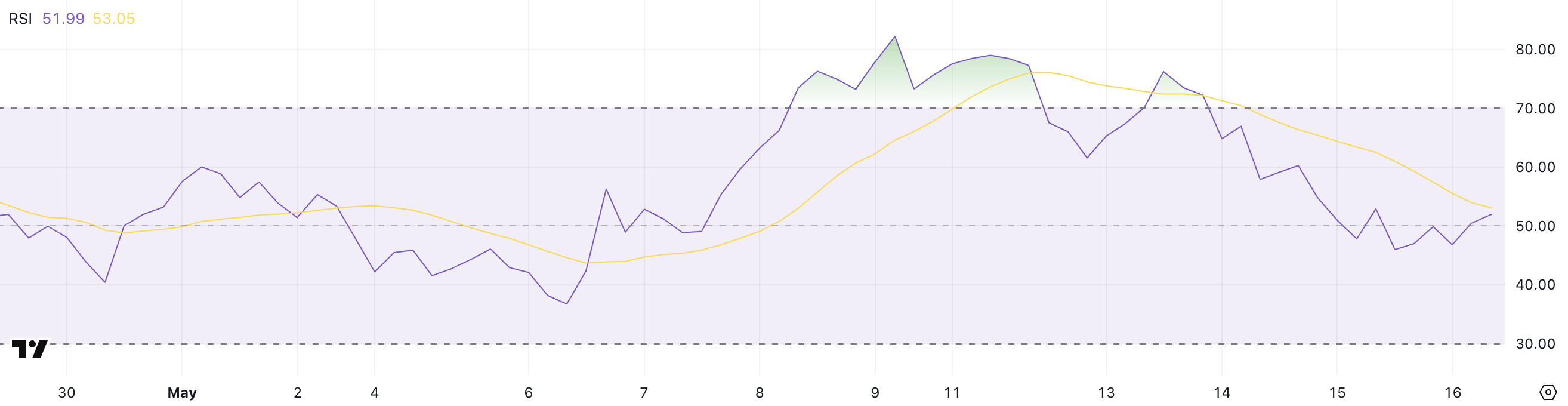

Solana’s relative strength index (RSI) fell to 51.99 from 66.5 just three days ago, indicating a clear loss of bullish momentum.

Over the past few days, the RSI has hovered between 44 and 50, reflecting more neutral market sentiment after approaching previously sold-out conditions.

This change suggests that traders are more cautious and that recent profits may be cooled.

RSI is a momentum indicator ranging from 0 to 100, with values above 70 indicating excess conditions and oversold areas of signaling below 30. At 51.99, Solana sat in the neutral zone, usually suggesting a period of integration or indecisiveness.

Once the RSI exceeds 60 again, it could point to a new strength being updated. If it drops below 45, the pressure on the lower side may continue.

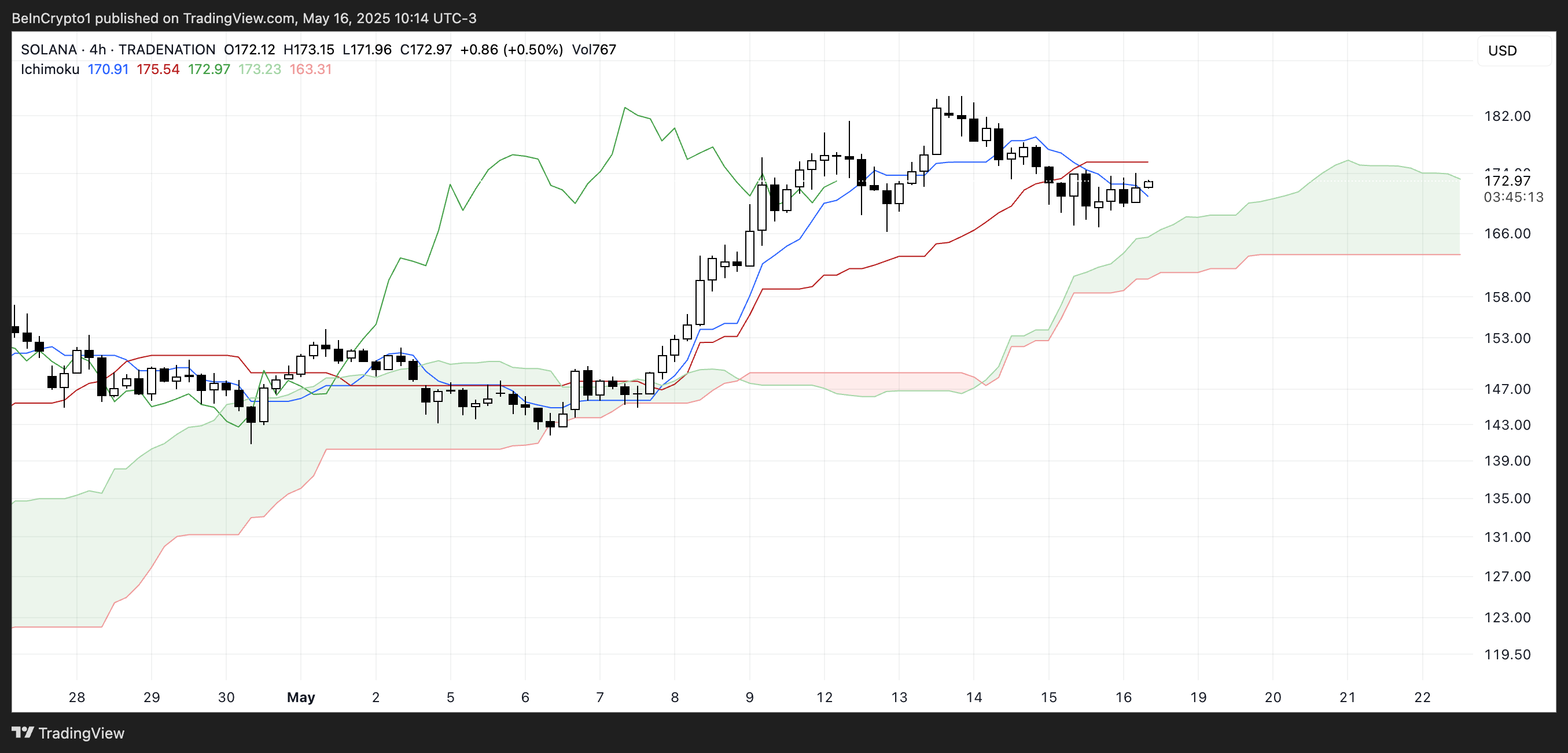

Solana’s Ichimoku Cloud Chart shows a period of integration following a strong uptrend, with key signals suggesting indecisiveness.

Prices were hovering near the Kijunsen (red line) and Tenkansen (blue line), both beginning to flatten.

The Chikou span (green lag line) remains above the candle, suggesting that the wider trend still has a bullish bias. However, the lack of distance between it and current price action reflects a decrease in intensity.

Kumo Cloud (area of green and red shading) is still bullish, with a leading span line widening, offering support under current prices.

However, short-term emotions appear cautious as the candle interacts closely with Kijun Sen and fails to break strongly on Tenkan Sen.

Momentum could return if prices can be pushed decisively above the blue line, but drifting into the cloud could mark the onset of a longer-term integration phase or a potential trend reversal.

Solana’s bullish EMA structure faces slowing momentum

Solana’s EMA line remains bullish, with the short-term moving average positioned rather than the long-term. However, the gap between these lines is narrower, suggesting a weaker upward momentum.

Solana Price has been unable to break past important resistance levels recently, and retesting could pave the way for regaining the $200 zone, but the lack of strong follow-through raises questions about the strength of the trend.

Complementing this careful outlook, the one-sided cloud and RSI indicators point to potential cooldowns. Solana recently took place beyond a critical support level, but if support breaks, there could be more downsides.

The wider structure is still bullish, but the market appears to be at a crossroads. The next move will depend on whether the buyer can regain the initiative or whether the seller can push the key low levels.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.