Several altcoins have been attracting analysts’ attention this July. These coins have received positive news, but their price performance still doesn’t reflect that momentum.

They may be undervalued or simply lack a small push to investors’ sentiment to trigger a strong rally. This article highlights three such Altcoins based on the latest news and expert opinions.

1. Theta Network (Theta)

Famous cryptography analyst Michael Van de Poppe believes Theta, the native token of Theta network, is considerably underrated despite the strong foundations of the project.

He pointed out that Theta is currently in the accumulation zone of the long-term charts. If the positive trend continues, he predicts that the token will be able to climb as much as 280%. This is a huge benefit for investors.

Michael highlighted recent positive news about Theta Network’s strategic partnership with FC Seoul. This football club is the first in the K League to employ the next-generation AI agent equipped with Theta Network.

“It reminds us that the project is far more underestimated because it is fundamentally developed. From a TA’s perspective, Theta integrates with a higher time frame support level, which is important.

2. Polka dot (dot)

Polkadot (DOT) is another Altcoin under the close watch, especially after Grayscale removed it from the digital large cap fund in July 2025. The decision sparked negative emotions among investors and limited the momentum of DOT’s recovery.

However, analyst Joao Wedson believes Dot is in the final stages of its accumulation phase and could break out soon.

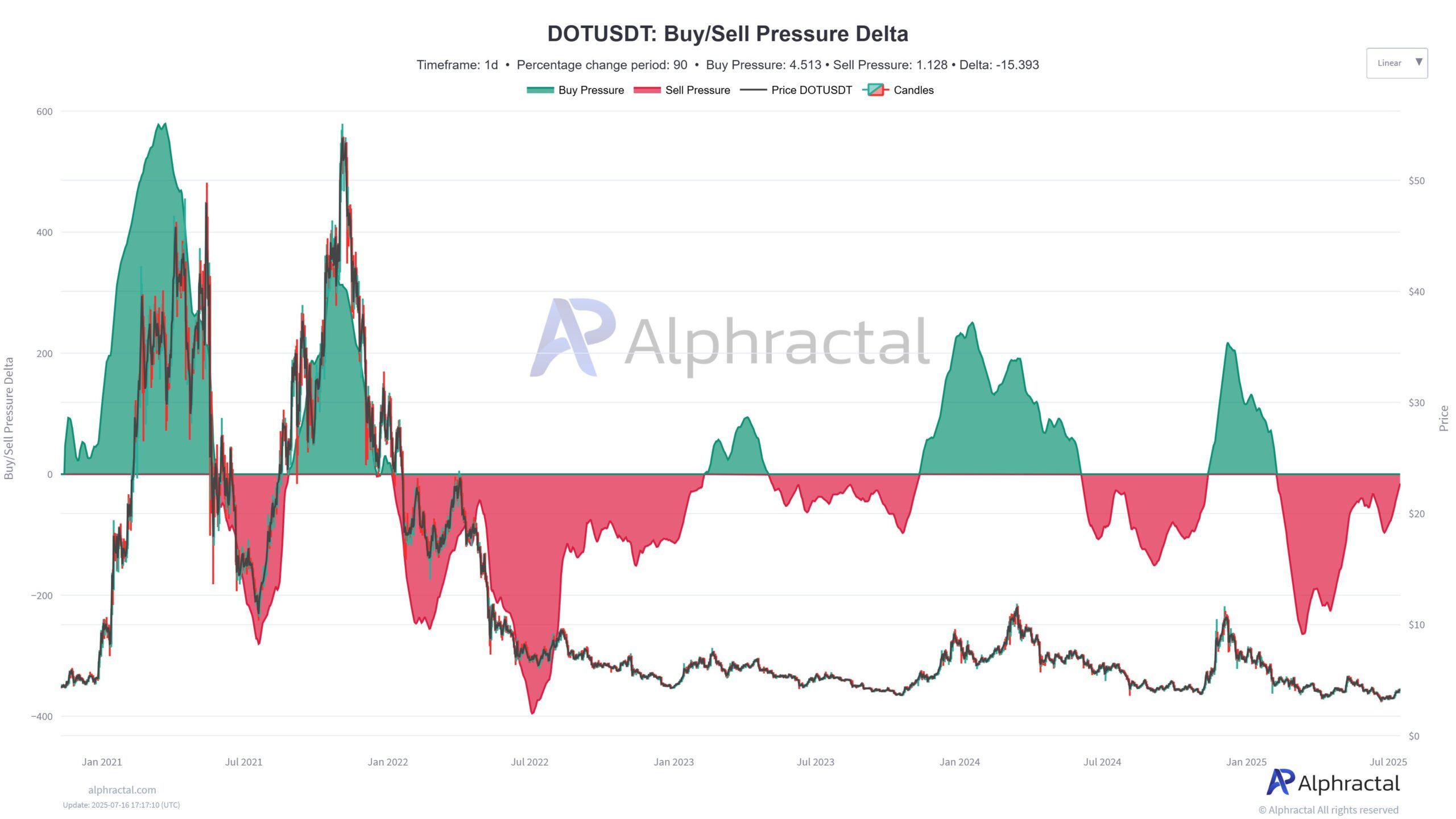

Joao observed that this metric has shifted from negative to zero by tracking the buy/sell pressure delta. This means sales pressure is weakening while purchasing pressure begins to dominate.

“DOT is about to close its accumulation phase soon. It ignores future volatility and unnecessary long liquidation. For Polkadot, there is no other way beyond going up!” predicted Joao Wedson.

Another X analyst, Hardy, agrees to this outlook. He believes dots are underrated and are approaching getting out of the accumulation zone, and now it’s a good time to buy potentially, potentially worth over $10.

3. Toncoin (Ton)

Ton’s latest positive development took place on July 15th, when the TAC blockchain launched its mainnet with the Ton network.

TAC is a blockchain designed to integrate distributed applications (DAPPs) using Ethereum Virtual Machine (EVM) with the TON ecosystem and telegrams. The integration leverages Telegram’s user base of over 1 billion people. This is beneficial to both parties.

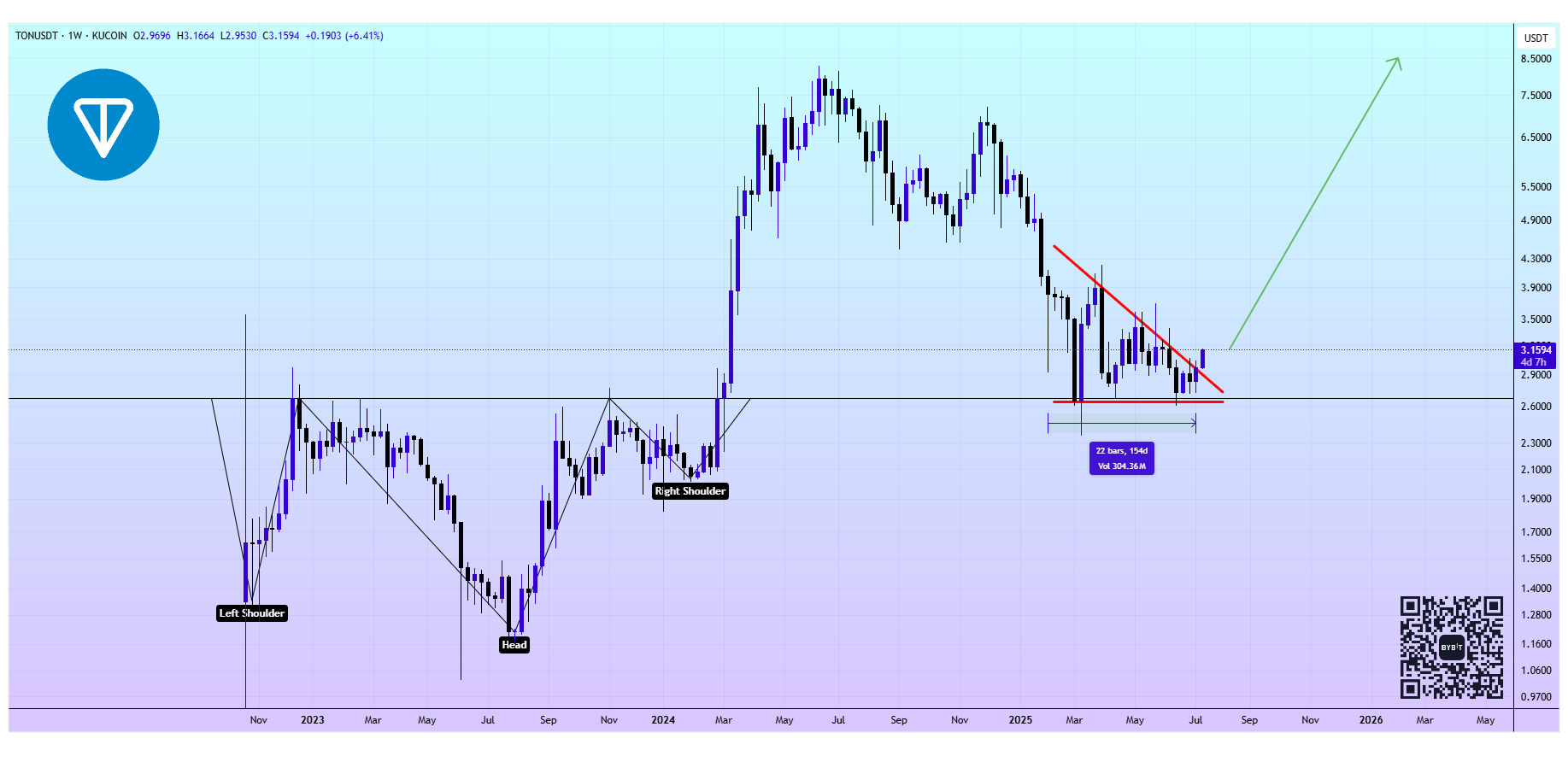

Tonne’s price performance shines brighter than ever before this year. But investor Alex Clay believes the coin is broken from a descending triangle pattern to an upside down.

“It’s the bottom for tons. 154 days to accumulate inside the triangle above the key level,” predicted Alex Clay.

Despite slow growth, TON holds above $2.7 and does not form a low. GlassNode’s cost-based distribution data shows that most of the TON supply accumulated at under $3.

With prices exceeding $3 in July, many analysts believe the accumulation phase is nearly complete, suggesting that Ton may be ready for a strong rally later this year.

At the time of this writing, Bitcoin’s dominance fell to 62.4%, the lowest since May. The decline in dominance is a key signal for the coming Altcoin season, supporting the wider Altcoin recovery potential this month.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.