Cardano (ADA) is under pressure, falling 4% over the past 24 hours and nearly 10% over the past week, with daily trading volumes falling 15% to $869 million. The decline in prices and activity is because several key indicators have weakened momentum and indicate increased uncertainty.

From the bearish bbtrend shift to the activity of volatile whales and the looming death threat of its EMA line, the ADA is facing a critical period. Whether it can retain support and regain strength or keep slipping will likely depend on short-term market sentiment and broader crypto conditions.

ADA shows weakness with Bbtrend below zero

Cardano’s bbtrend has become negative and is currently sitting at -2.43 after spending nearly five days in positive territory.

Between May 11 and May 16, the indicators exceeded zero, reaching the latest high of 17.34 on May 12.

This change suggests that recent upward momentum has faded and assets may be in a new phase of weakness or integration.

BBTREND (Bollinger Band Trend) measures measurements that provide insight into the strength and direction of trends by dissipating prices significantly from the average compared to volatile.

Values above zero usually indicate bullish momentum, while values below zero suggest an increase in bear pressure. The ADA currently shows a bbtrend of -2.43, indicating a potential shift to downside bias.

If this negative trend persists, it could lead to a period of stagnation until further price weakness or new purchase rights return.

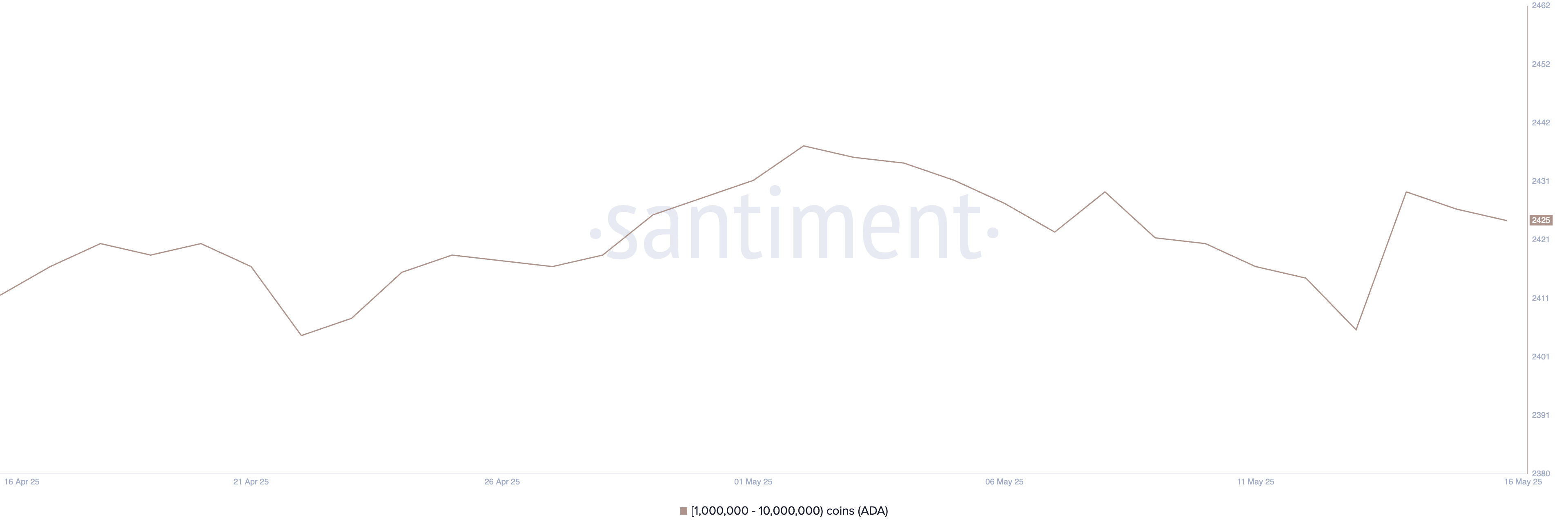

Cardano whale activity is cooled after short-lived spikes

The number of Cardano whale addresses (sheds holding ADAs of 1 million to 10 million) has experienced significant volatility in the past few days. On May 13th, the number fell to 2,406, marking one of the lowest points in the past month.

A sudden rebound continued on May 14th, with whale wallets jumping to 2,430, suggesting a brief renewed interest among large holders.

However, this increase did not hold as the increase again fell over the next two days and had now settled at 2,425. Variation highlights the lack of convictions among key players, with persistent accumulation and inconsistent distribution.

It is important for these large investors to monitor whale activity as the size of their holdings can drive key price movements.

Rising whale numbers generally refer to the possibility of signaling accumulation, long-term trust and supporting an upward price movement. In contrast, a decrease or stagnation of whale numbers often suggests hesitancy or sales pressure, which can put pressure on price momentum.

With current counts still below peak levels and showing instability, Cardano may struggle to build strong bullish momentum in the short term unless accumulation resumes more decisively.

Cardano at risk of death as a Coors Eyes Key Support Level

Cardano’s EMA structure shows early signs of debilitating, with short-term moving averages beginning to immerse towards the long-term.

This bearish crossover often marks the beginning of a deeper downtrend. If confirmed, Cardano Price may test support levels at $0.729.

A break below that could open the door to further losses at $0.68, and with a more aggressive sale, the price could fall by $0.642.

However, once the current momentum changes and the Bulls regain control, the ADA has the opportunity to turn the course back.

The first important target is to exceed the $0.781 resistance. If that level is cleared, Cardano could rally to $0.841, reaching $0.86 for a strong bullish move.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.