In the last week of July, total public interest on the Crypto Derivatives market has historically been high, exceeding $200 billion. Currently, significant price transfers can cause significant losses in both long and short positions.

However, some altcoins have shown signs of potentially large liquidation this week. Let’s take a closer look at which one.

1. Ethereum

Ethereum has been surrounded by positive news about institutional accumulation over the last few months. Sometimes, even the inflow exceeded the inflow of Bitcoin ETFs. Most recently, Sharplink Gaming acquired 77,206 ETH, worth $296 million last week, increasing its total holding to 438,000 ETH.

These bullish developments brought ETH closer to the $4,000 mark in the final week of July. Many analysts hope ETH will hit $4,000 soon. However, this level also serves as a powerful psychological resistance that can make profits appear at any time.

“The main resistance level for Ethereum $ETH is $3,980. Commented by Crypto analyst Ali Martinez.

Regardless of direction, the liquidation map shows that potential liquidation could reach billions of dollars if ETH moves significantly.

According to Coinglass data, if ETH exceeds $4,000, the accumulated short liquidation total could reach $1.2 billion. Meanwhile, if ETH makes strong profits and drops to $3,500, the long liquidation could surge to $7.8 billion.

The map also reveals the imbalance between long and shorts, indicating that many traders bet more money and take advantage of downward corrections.

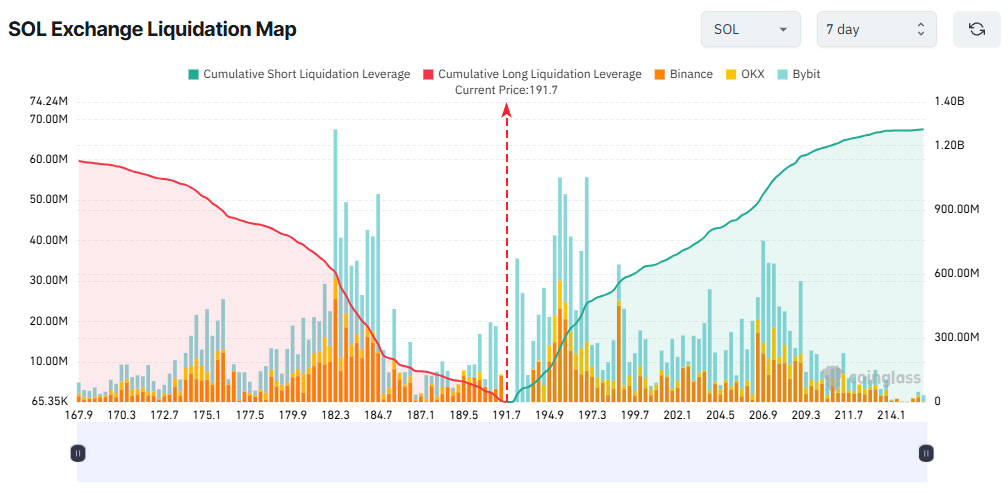

2. Solana

Solana will need to exceed 50% to revisit its initial high to nearly $300, but its public interest has already exceeded $11 billion. This is more than 25% higher than when Sol peaked in January.

This suggests that traders are exposed to Solana more than they have in the past. However, most of this exposure comes from derivatives rather than spot trading.

CoinMarketCap data shows Sol’s current daily spot trading volume is only $6 billion. That’s well below the tens of millions of billions seen in January.

This wide gap between derivatives and spot volume reflects Solana traders’ leaning towards short-term bets. As a result, tokens are prone to sharp swings and potential liquidation.

The liquidation map shows the balance between strengths and short positions. Sol Trading is around $191, and moves above $200 could lead to a liquidation of over $600 million. Conversely, a decline to $181 could liquidate a longer position of $700 million or more.

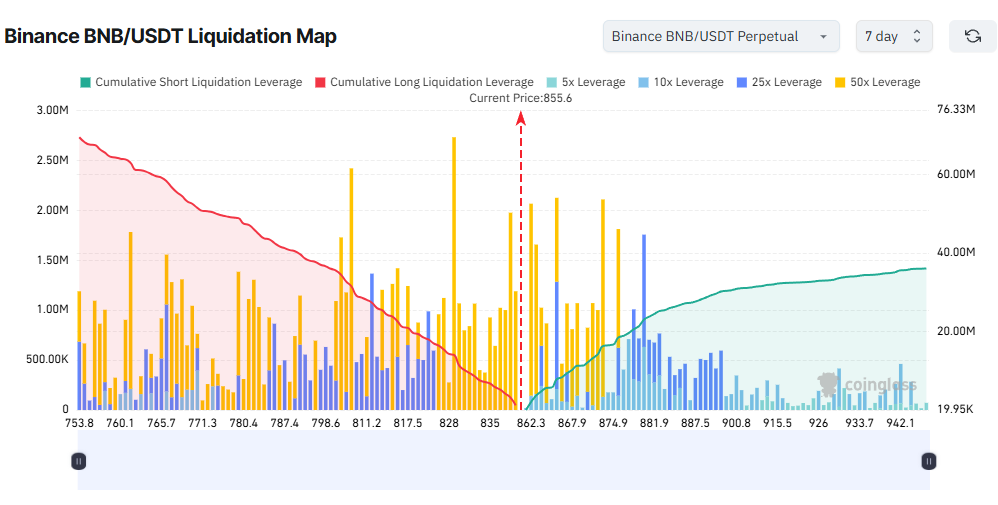

3. BNB

Entering the final week of July, BNB recorded a new all-time high of $859. The rally was driven by an increase in activity in the BNB chain and a growing interest from businesses in the BNB Ministry of Finance.

BNB has yet to show any signs of pullback, but the BNB/USDT liquidation map reveals 50 times the heavy leverage on Binance liquidation map.

The map is almost completely covered in yellow (indicating 50x leverage), especially in the range of around $753 to $875.

With Binance alone, the total settlement exceeds shorts. If BNB exceeds $875, a short position worth $18.5 million could be liquidated. Meanwhile, if BNB falls below the psychological $800, it wipes out long positions above $36 million.

Ignoring short-term noise, many analysts believe BNB could soon reach $1,000. However, some offer a more detailed view, suggesting that prices could initially fall below $800 before resuming the upward trend.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.