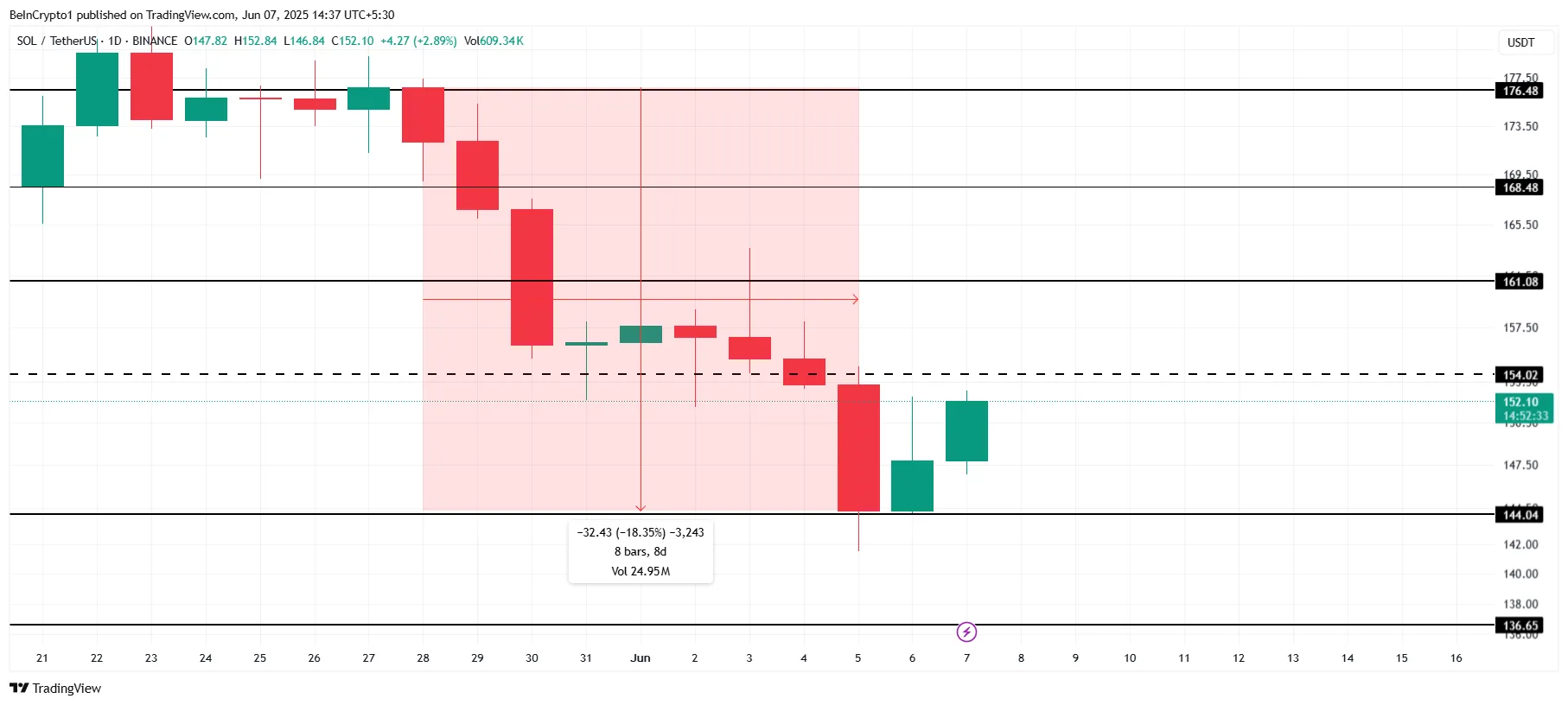

Solana (Sol) has recently dropped sharply, falling from $176 to $141 in just eight days. After this serious recession, many traders wanted a recovery.

However, Altcoin’s path to regaining lost ground faces challenges, primarily because changes in investor behavior could slow down or prevent further price increases.

Solana Investors are selling

Long-term holders (LTHS) have moved from solid buyers to sellers. The leaks from LTH wallets have recently skyrocketed to two months high. This is a movement that has not been seen in the past month.

This change in behavior indicates a major market change, as LTHS is often seen as the backbone of asset price stability.

Consistent sales from these investors raise questions about Solana’s price stability in the short term. Because LTH is generally considered a more patient investor, their decision to sell indicates a potential loss of trust.

Solana’s macro momentum remains a concern as it continues to show market conditions where key technology indicators have weakened.

The 50-day index moving average (EMA) and 200-day EMA, closely monitored by traders, show signs of continuous bearishness. The Cross of Death, which began in March, is still playing.

The 50-day EMA approached crossing beyond the 200-day EMA in late May, indicating that recovery may not be imminent. This continued bearish trend puts Solana’s recovery at risk.

If the death cross persists and the EMA continues to diverge negatively, it could indicate a further price drop.

Sol Price requires a push

Solana prices have fallen 18% in the last eight days, but have recovered slightly in the last 24 hours, rising 5%. Currently trading at $152, Sol faces great resistance at the $154 level.

This barrier is extremely important in the short term for potential bullish moves. If prices fail to break through this resistance, they could drop even further.

Given current market sentiment and technical indicators, Solana’s price may struggle to violate the $154 resistance. Instead, you might see a pullback towards $144. If this support is not retained, the price could drop to an additional $136.

However, if the broader market situation improves, Solana could experience a gathering. A breakout that exceeds the $154 resistance pushes the price to $161. Once you reach this level, the death cross pattern ends, helping you to restore investor confidence and negate bearish outlook.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.