After Bitcoin surged to an all-time high in May, Altcoin Ethereum’s lead traded temporarily at a multi-month peak of $2,789 on May 29, experiencing a new rise in trading activity.

However, as the broader market has cooled over the past two weeks, ETH’s price action has been tightened and consolidated within a narrow range. Nevertheless, market analysts remain broadly bullish on the outlook for ETH for June.

Ethereum’s outlook becomes bullish as the system’s ETF inflows surge

In an exclusive interview with Beincrypto, Wantane CEO Temujin Louie said that Eth’s outlook for the month is “increasingly bullish” and driven by a consistent influx of Ethereum Exchange-Traded Funds (ETFs) and new network stability.

“Continued investment in Ethereum ETFs shows strong institutional benefits and strengthen the reliability of ETH as a long-term asset. Ethereum’s recent Pectra upgrade was also a huge success, quieting the internal conflict within the Ethereum Foundation.

Additionally, Kronos Research analyst Dominick John confirms this optimism and highlights the impact of a surge in ETF inflows on Coin’s price action. According to John:

“ETH ETFs have surged institutional interests that are shaping recent price behaviors significantly, reducing volatility while increasing market liquidity. This wave of demand, combined with strong foundations such as stubcoin strength and solid on-chain signals, tightening supply and supporting sustained interest.”

According to Sosovalue, ETH-backed ETFs have witnessed an increase in weekly inflows since May 16th. This week, net inflows into these investment vehicles totaled $286 million, highlighting the growing confidence among institutional investors.

If this continues, it could put upward pressure on ETH prices, triggering a break above the narrow range in June.

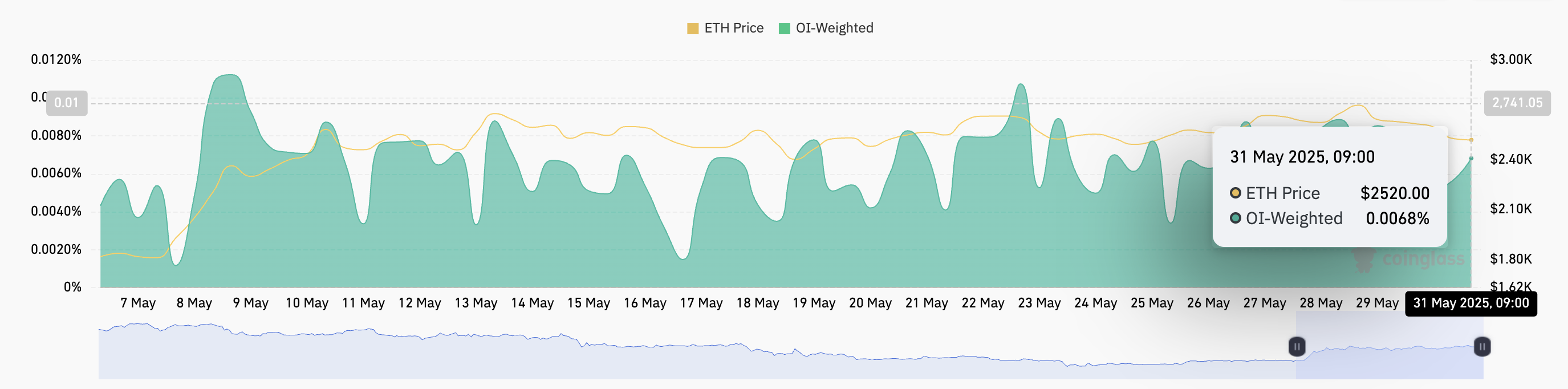

Furthermore, ETH’s consistently positive funding rates further support this bullish outlook. At the time of this writing, ETH’s funding rate is at 0.0068%, reflecting the continued trust from leveraged traders willing to pay a premium to maintain their long position.

Funding rates are used in perpetual futures contracts to ensure that the contract price matches the spot price of the underlying asset. When the capital raises positive rates of assets, traders who hold long positions pay for those who hold short positions. This shows that market sentiment is bullish as more market participants bet on price increases.

The sustained positive funding rate of ETH is consistent with a significant institutional influx into ETFs supported by ETH. Another layer of confirmation that market participants are making even more profitable in June will be added.

There’s a catch

Despite ETH’s bullish outlook in June, these analysts warn that broader macroeconomic terms could pose risk to the short-term performance of assets.

Louie emphasized that while the ETH foundations remain strong, the main Altcoin “remains vulnerable to macroeconomic conditions.”

“Despite the current bullish momentum, the crypto market remains speculative overall and responds sharply to inflation data, interest rate expectations, changes in Federal Reserve policy, and other external factors. While Ethereum’s fundamentals continue to be strong, short-term price trends could be quickly reversed by harmful macroeconomic trends,” he said.

John also added that the Federal Reserve’s June 17 FOMC meeting is a notable meeting.

“The broader macro trends, especially inflation data and Fed rate policies, will remain crucial for price action. Decisive pivots can enhance ETH breakouts, especially with sustained ETF inflation. However, Hawkish’s attitude will maintain stable domination, staking yield, and growth that underlies tier staking to maintain stable domination, staking yield, and layer 2 growth.

As ETH enters optimism in June, investors will need to watch the macroeconomic signals carefully as they are likely to shape the price trajectory of ETH over the coming weeks.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.