The Bitcoin rally to a new all-time high of $122,054 has sparked a wave of profitability across the market. On-chain data shows signs that institutional appetite may also be cooled.

After a strong six-week streak of net inflows into US list spot Bitcoin ETFs, there was a comeback this week, with some funds logging outflows.

Institutional investors withdraw $199 million from BTC ETFS

According to SoSovalue data, Spot Bitcoin ETF overturned a six-week net inflow streak, recording a total of $190 million this week. This shift shows a major emotional shift among institutional investors who have steadily accumulated BTC exposure through ETFs throughout most of recent gatherings.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

The pullback will be its new highest high of $122,054 following a surge in coins on July 14th. Several investors who were keeping an eye on the critical breakout of over $120,000 appear to have seized an opportunity to leave their position and lock up gains.

ETF flows are widely regarded as an important indicator of institutional trust. The sudden decline in influx, especially after sustained accumulation, suggests that institutional risk appetite is chilled. That means that even veteran owners, often considered to have “drawn hand,” are profiting.

This is not necessarily a sign of long-term bearishness, but it reflects the growing short-term attention in the market.

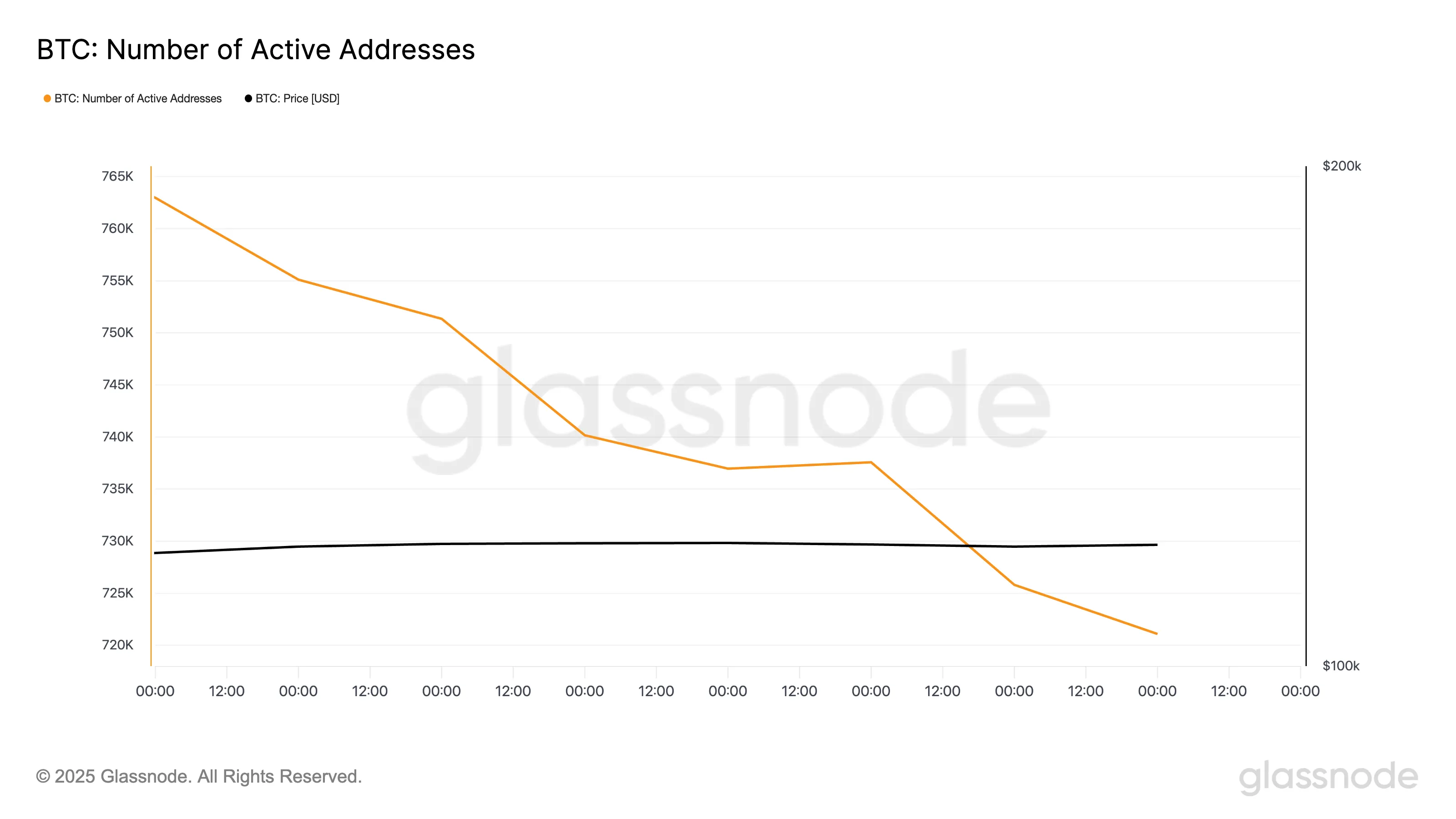

Furthermore, GlassNode data show weakening of on-chain activity that could exacerbate the risk of BTC drawbacks. According to data providers, the number of active unique addresses on the Bitcoin network has gradually plummeted over the past seven days. Yesterday it closed at a weekly lowest address of 721,086.

As institutional capital begins to be pulled back and retail activity slows simultaneously, it indicates a wider market suspension, increasing the likelihood of price adjustments for short-term BTC.

BTC’s eyes are a $120,000 breakout, but weak demand falls

Daily measurements for BTC/USD show that Kingcoin has been mostly trending within range since it reached an all-time high of $122,054 on July 14th. Currently facing resistance at $120,811, with the support floor formed at $116,952.

As demand slows, the coin risks testing this level of support. The price of BTC drops to $114,354 if not retained.

However, once new demand enters the market, the coin could violate the $120,811 barrier and attempt to retrieve an all-time high.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.