Even after Coinbase launched a wrap version of its native token Cbada on Base, which is the Ethereum Layer 2 network, Cardano’s price action has remained insufficient for the past 24 hours.

Altcoin has not been able to use the announcement, indicating its price performance has been low since its deployment.

Cardano extends losses despite CBADA being live on base

On Wednesday, Cryptocurrency Exchnage Coinbase’s leading Cryptocurrency Exchnage announced the launch of Cbada, a wrap version of Cardano’s native coin, on the Base Network.

Cbada is fully supported by the ADA held at Coinbase Custody in Coinbase custody, aiming to bring Cardano liquidity into the Ethereum defi ecosystem.

However, despite the addition of utilities, this development failed to increase the demand for ADA in the past days. The coin trades at $0.564, down 3% the previous day.

During that period, its trading volumes skyrocketed by almost 10%, confirming sales pressure for mountaineering. At the time of writing, the ADA’s daily trading volume is $649 million.

When asset prices drop while trading volumes are rising, strong sales pressure will arise as market participants offload positions. This pattern shows bearish sentiment among ADA holders, with prices expected to fall further as sales continue.

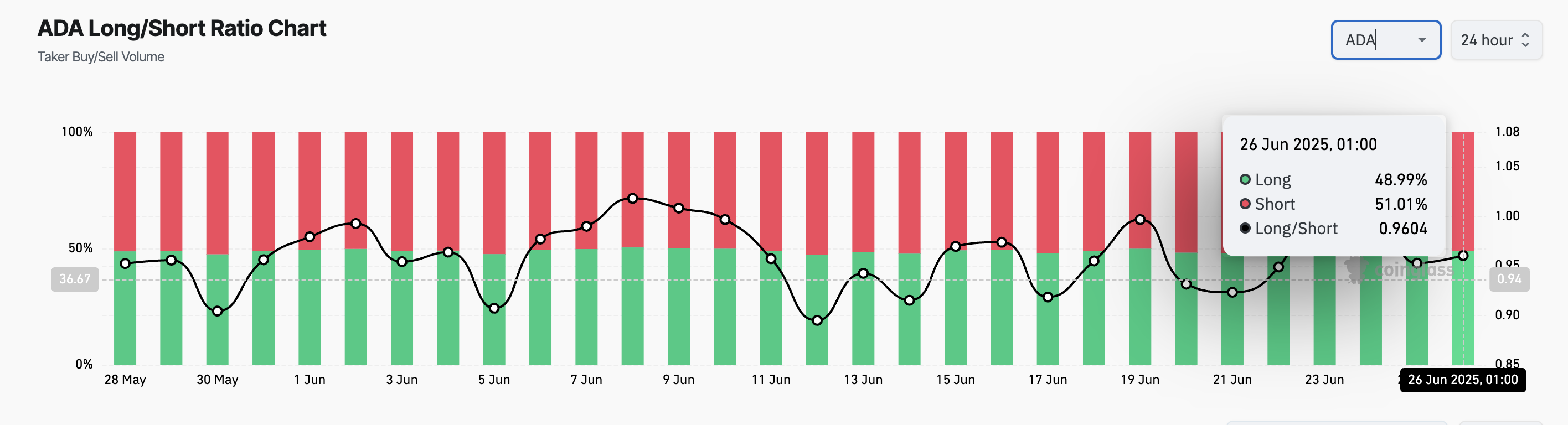

Furthermore, the long/short ratio of ADA in the Futures Market is leaning significantly in favor of shorts. At press, this is 0.96.

This ratio compares the number of long and short positions in the asset futures market. If its value exceeds one, it can be longer than a short position, indicating that traders are primarily betting on price increases.

Conversely, as seen in the ADA, ratios below one indicate that most traders are positioned for declines. This indicates an enhanced bearish sentiment and heightened expectations for the ongoing negative side movements among ADA owners.

Cardano slips when the seller takes control

On the ADA/USD Daily Chart, negative measurements from the Coin’s Balance of Power (BOP) support the above bearish outlook. Currently, this is -0.18, suggesting the seller’s control.

The BOP indicator helps measure the strength of buyers and sellers in the market and identify changes in momentum. If that value is positive, buyers will dominate the market more than sellers and will encourage new prices to rise.

Conversely, negative BOP measurements indicate the presence of strong bearishness, suggesting further reduction. If this trend persists, the price of the ADA could extend the decline to $0.511.

butthe value of the coin could rise to $0.642 in the case of demand climbs.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.