The US Spot Ethereum ETF has recorded 15 consecutive trading days of net inflows since May 16th, winning $837.5 million.

The influx streak began a week after the Ethereum Pectra upgrade. This has increased the EIP-7702 transaction to nearly 1,000 in nearly a day, and enhanced the wallet functionality without changing addresses.

Ethereum ETF has hit a $837.5 million inflow streak

These inflows account for approximately 25% of all net inflows since the funds launched in May 2024. This marks the longest uninterrupted inflow period for ether ETFS since late 2024.

According to SoSovalue data, the Spot Ethereum ETF is ranked at the highest cumulative inflow value ever, currently totaling $3.33 billion.

BlackRock’s ETHA funds lead the Ethereum ETF market in individual inflows, contributing nearly $600 million during this surge. Etha boasts the highest influx, but Grayscale’s dual offerings Ethe and Eth hold a larger asset base at AUM of $4.09 billion compared to Etha’s total.

Meanwhile, Fidelity offers $10.9 billion in trails, with other funds below $250 million. In particular, the surge coincides with 38% of the price of ether over the past 30 days.

Key drivers include new institutional interests, optimism about the long-term foundations of Ethereum, and recent Pectra upgrades to the network. Against these backgrounds, analysts are optimistic about the Ethereum price outlook.

Nevertheless, JPMorgan analysts noted that user activity on the Ethereum Network has not yet significantly accelerated post-upgrades while institutional allocations are increasing.

“We have never seen any significant increase in either the number of daily transactions or the number of active addresses since the recent upgrade,” JP Morgan Analyst led by Nikolaos Panigirtzoglou wrote in a recent report.

If the current pace continues, Streak could potentially exceed $1 billion by next week. Such results further emphasize the sharp pivot of sentiment after a relatively calm start in the etheric ETF.

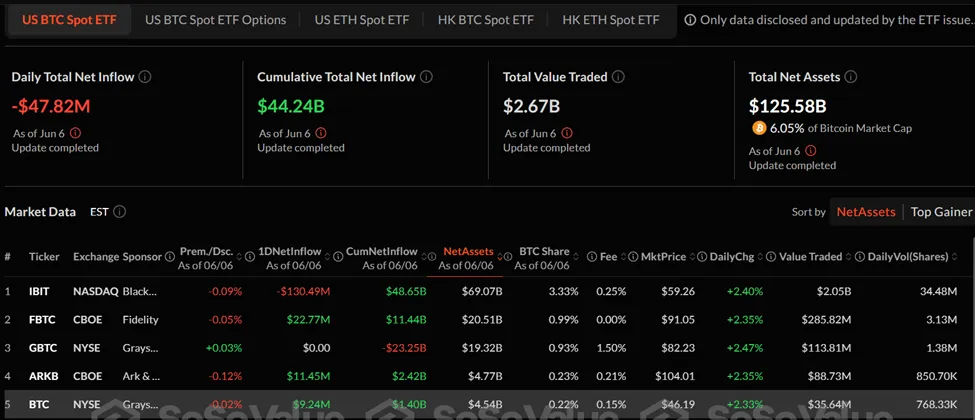

Bitcoin ETF retreats after record highs

The Ethereum ETF continues to gain momentum, but the same cannot be said about its Bitcoin counterpart. The Spot Bitcoin ETF saw a break from its recent influx streak on May 29, when $346.8 million closed the market in one day.

Since then, Bitcoin ETF flows have turned volatile, with cumulative inflows down over $1 billion. That’s $442.4 billion as of Friday’s trading session, starting from $45.34 billion on May 28th.

BlackRock’s IBIT manages $69 billion in assets and remains a category leader with a wide margin. Fidelity’s FBTC and Grayscale’s GBTC continue with AUMs of $205.1 billion and $19.32 billion, respectively.

The market also experienced a brief turbulence after a fierce online exchange between President Donald Trump and Elon Musk caused a wider sale in the crypto market and stocks.

We shine a spotlight on staking and ETF innovations

As investors’ interest in Ether ETFs accelerates, some analysts argue that future inflows will depend on whether staking features will be introduced. Bloomberg ETF analyst James Seyfert recently highlighted workarounds for regulations being employed to launch staking-enabled ETFs.

ETF provider Rex Shares has already applied for Ethereum and Solana Staking ETFs, and the first such products could arrive in the US within a few weeks.

The growing demand is also reflected in the broader Ethereum adoption metrics. According to Santiment, the number of Ethereum holders now exceeds 148 million.

This indicates a long-term conviction on assets. By comparison, Bitcoin has 55.39 million holders, while other popular assets such as Dogecoin, XRP and Cardano report between 40 and 8 million holders.

With the Ether ETF now delivering the strongest performance ever, the spotlight is firmly in mind whether this momentum can last.

Perhaps the provision of staking responses may drive the next wave of institutional adoption.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.