Bitcoin prices have fallen since late May and are now around $105,000. While this level serves as psychological support, BTC faces uncertain outlook that could shape its June performance.

BTC is currently weighing bullish optimism against potential sales pressures as the final month of the second quarter begins.

Bitcoin is not yet facing “taking profits from the masses”

The MVRV deviation price range indicates that Bitcoin is close to overheating levels, but has not yet passed the +1σ band. Historically, this threshold causes large profits as investors try to lock them in. For now, the market appears to have room for growth, delaying widespread sales.

Bullish momentum could continue until Bitcoin exceeds this critical MVRV level, encouraging continued investment.

However, caution is required. It is important to closely monitor the MVRV band. This is because if you surpass this point, your emotions can change quickly. This will make June a significant month and Bitcoin price action could swing sharply in response to investor behavior and macroeconomic impacts.

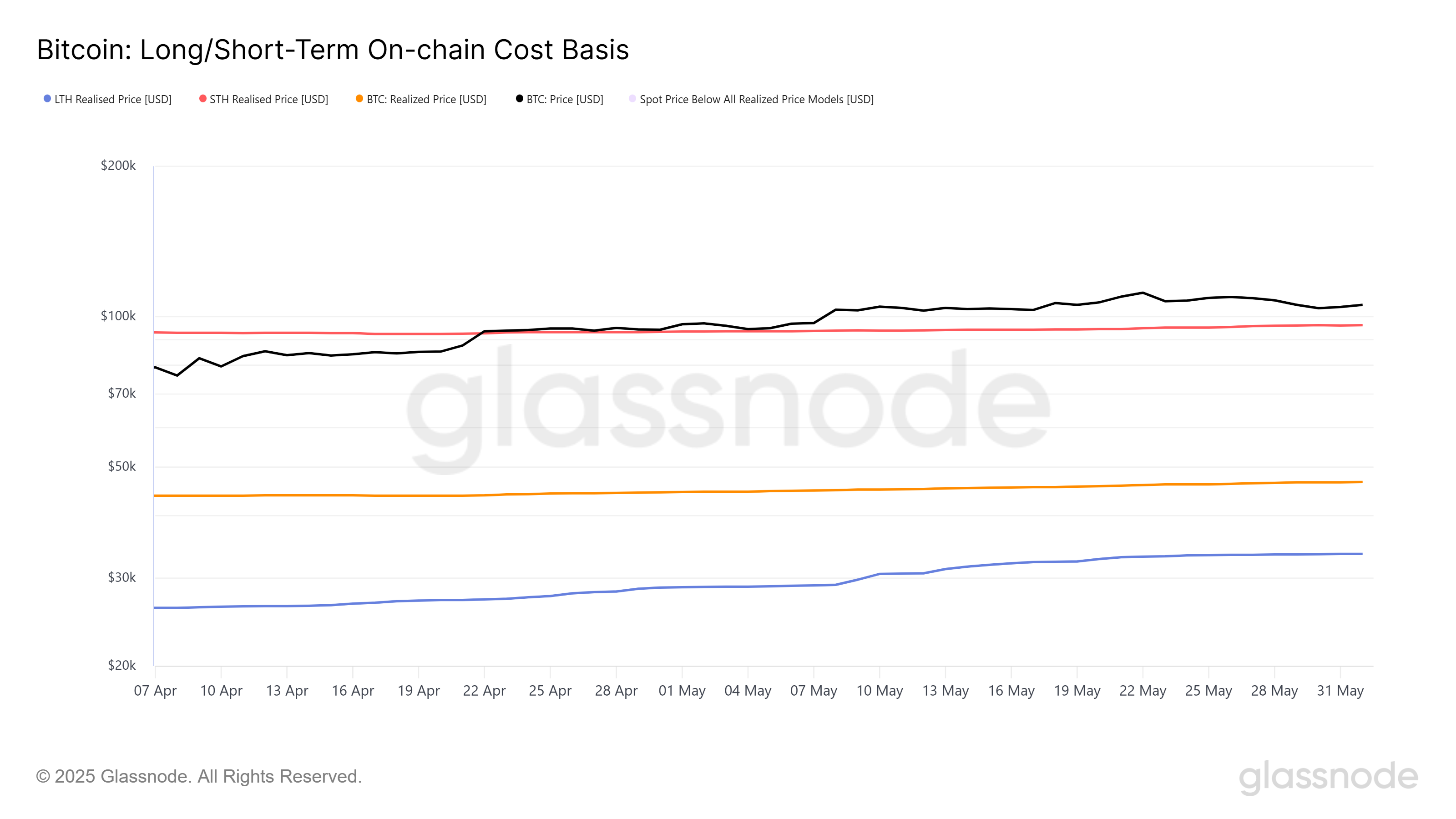

On-chain data reveals long-term holder (LTH) and short-term holder (STH) cost-based dynamics, shedding light on Bitcoin’s momentum. STH has made its current market price at $96,113, below $105,238. This gap suggests that short-term holders are profitable. This is usually a sign of bullishness as these investors are likely to buy or hold.

Furthermore, the $33,555 LTHS cost base is well below market price. However, as these holders tend to refrain from selling in most cases, a rise in profit is not an immediate concern for Bitcoin price.

Nevertheless, STH’s profitability raises concerns as they may choose to sell to realize profits that could put downward pressure on BTC prices. This balancing act between holding and selling is important in determining the Bitcoin trajectory through June.

BTC prices require stability

Bitcoin is trading at $105,238, maintaining a critical level of psychological support of $105,000. This stability has restored investor confidence after recent volatility and set the stage for potential upward movements.

If bullish momentum continues, Bitcoin could violate the $106,265 resistance and support it. However, if you surpass the $110,000 barrier, it could prove challenging due to profit-raising pressures and historical resistance at this level.

Conversely, if short-term holders start selling and securing profits at current levels, Bitcoin could fall below $105,000. A decrease below $102,734 disables bullish outlook, suggesting an increase in vulnerability, and perhaps indicates the onset of a deeper fix.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.