The popular Altcoin Solana has flowed nearly 10% of its value over the past week, and bear pressure doesn’t seem to be disappointed. The token fell to $129 today as geopolitical tensions between the US and Iran escalated.

With the second quarter of 2025 being drawn in closely, Mount Seloff risked its price below the Solana price of a significant support level of $130. This analysis explains how to do this.

Sol slip as a key indicator remains bearish

Over the past seven days, prices for Sol have steadily dropped. This involves flooding of the coin’s chaikin money flow (CMF), which falls deep into negative territory. At the time of writing, Sol’s CMF is -0.13.

The CMF measures the flow of money in and out of assets for a specific period, typically 20 or 21 days. Combining price and volume data to assess trading pressure. When the assets’ CMF is positive, the amount of purchases dominates, with capital flowing into the assets, indicating potential bullish sentiment.

Conversely, if the CMF changes to negative, the sales volume will exceed the purchase volume. In other words, money flows. This indicates that the demand for SOL is weakened, especially during deeper negative measurements.

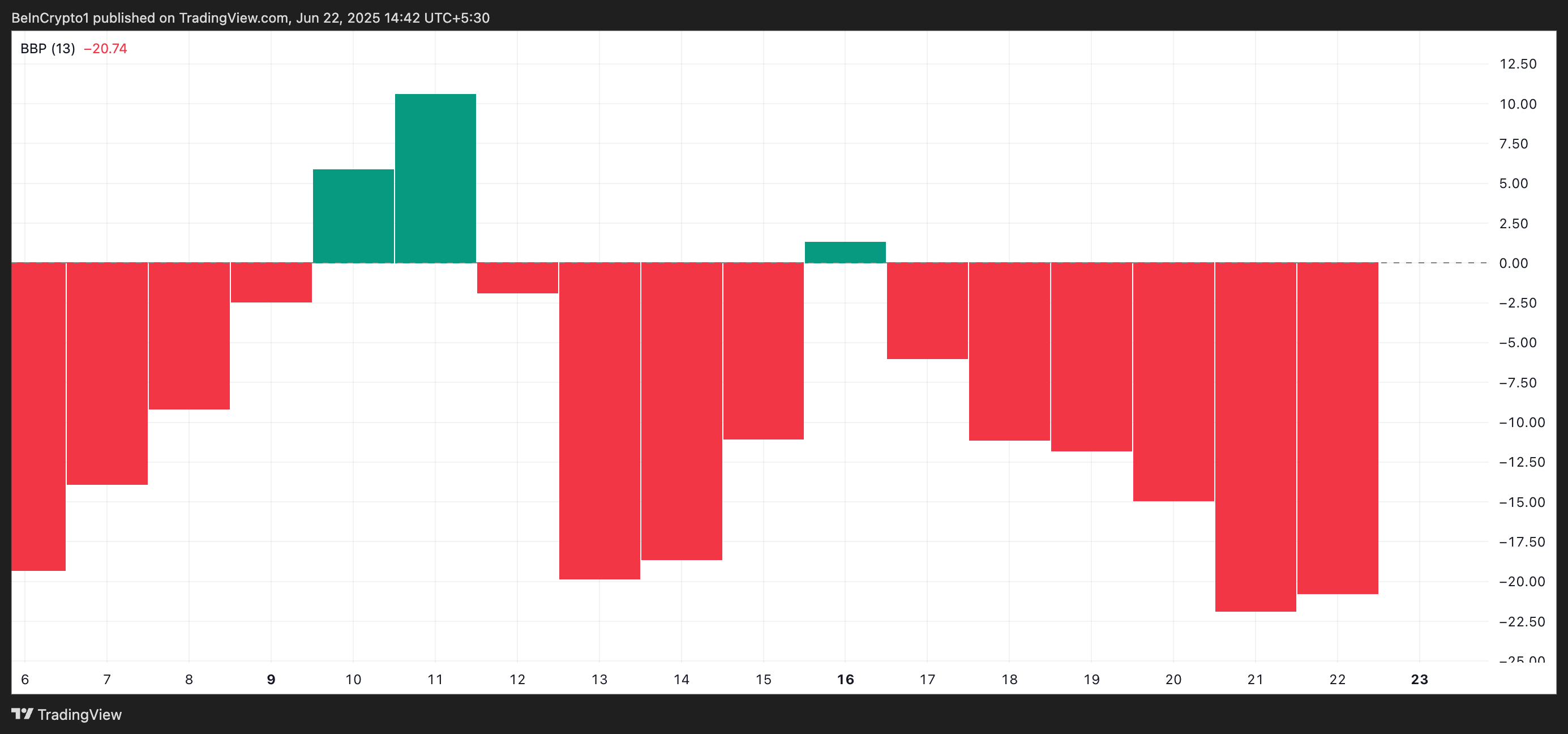

Furthermore, Coin’s Elder-ray index, which measures the balance between buyers and sellers, is -20.74, indicating that the sellers are in good control.

This indicator measures the strength of bulls and bears in the market by analyzing the differences between asset prices and moving averages. If it is negative, the bears dominate as they consistently fall below average and suggest that sales pressure is above the buy interest.

Will Sol recover above $130 or close to $123?

This bear domination reflects growing confidence that Sol’s prices could drop even further, especially if $134 cannot be held as a support floor.

Meanwhile, a breakdown below this level could open the door due to deeper losses and drag Sol to $123.49.

However, if the Bulls can regain control, they could raise the Solana price to $142.59.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.