Generally, crypto and financial markets are upset from new volatility and upset from the attachment of geopolitical pressures. As a result, speculations have been strengthened as to whether the Federal Reserve will return to quantitative easing (QE).

Potential QEs would be reminiscent of aggressive financial interventions in 2008 and 2020. For crypto, many traders can be very important as they have a historic gathering if a potential V-shaped recovery and QE is revived.

Analysts share why the Fed can act

Analysts share the reasons that could encourage the Fed to intervene, citing the Move Index. This is Wall Street’s “Horror Gauge” for the bond market. At 137.30, the index is currently within the 130-160 range where the Fed acted historically during the crisis.

“Now that’s 137.30, a range of 130-160 where the Fed may step in depending on the economy. Otherwise they’ll still cut interest rates as they’ll have to refinance their debts to continue with the ponge.”

This signal coincides with other warning signs of financial instability, including the sale of global markets that set the tone of the Crypto Black Monday narrative. This has led the Fed to schedule a meeting for the closures department on April 3rd.

According to analysts, the timing was not random, increasing the pressure that could likely be seen as Fed caves and President Trump on his path.

“Everything changes the risk as the Fed hints at QE. The rewards have been favored by the bull. Beware of choppy price actions. But you won’t miss a recovery rally. And remember…it’s easier to trade this market than to maintain it.”

This suggests that investors are reading between lines. Particularly due to the Fed’s next planned policy decision from May 6-7. JP Morgan recently became the first Wall Street Bank to predict a US recession amid the tariffs proposed by Donald Trump, adding urgency to the conversation.

Banks suggest that before the FOMC meeting where FOM is scheduled, they could be forced to act faster and faster, perhaps even with interest rate cuts or QE. Against this background, crypto investor Eliz shared a provocative take.

“To be honest, I think Trump is doing all this to speed up the Fed’s process and reduce rates and QE,” they pointed out.

That may not be overstated considering the Fed must manage more than $34 trillion in federal debt. Notably, this makes it difficult to serve at higher interest rates. Currently, there is a 92% chance that the Fed will cut interest rates at some point in 2025, according to Polymarket.

Why Crypto can benefit from QE

If QE were to come to fruition, history suggests that Crypto could be one of the biggest beneficiaries. Bitmex founder and former CEO Arthur Hayes predicted that QE could inject up to $3.24 trillion into the system.

“Bitcoin has risen 24 times over Covid-19 thanks to a $4 trillion stimulus. If we look at $3.24 trillion now, BTC could reach $1 million,” he said.

This coincides with his recent forecast that if the Fed moves to QE to support the market, Bitcoin could reach $250,000 per year end.

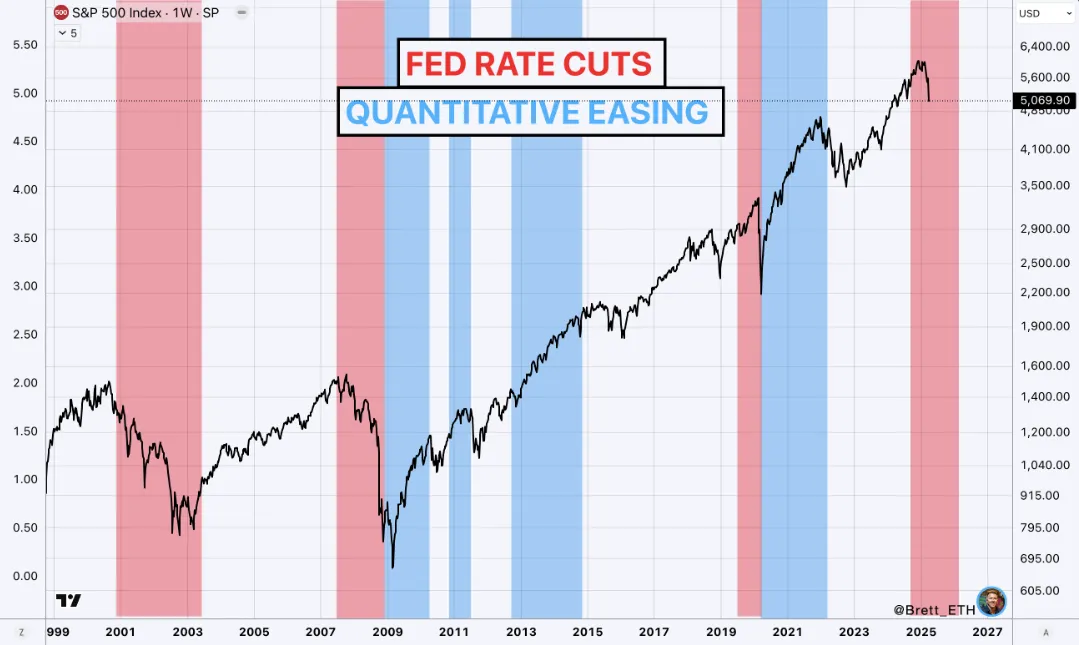

Analyst Brett provided a more measured view, noting that QEs typically follow rate reductions rather than precede them.

“We could see rate cuts by mid-2026, like 2008 and 2020. Powell said that QE will not come until the rate cuts are complete,” Brett explained.

Based on this, the analysts promised to buy selectively, but they didn’t expect a V-shaped bounce unless something dramatic changed.

That “something” could potentially turn Trump back his tariffs or overturn the Fed front, where emergency mitigation measures are in place. If either of them happens, the crypto market could gather violently and quickly.

Alto season on the horizon?

Meanwhile, our cryptography talk states that quantitative easing in May could lay the foundation for the potential of the Altcoin season.

Their forecasts reflect the previous cycle in which QE triggered an explosive movement with risky assets. When QE kicked off in March 2020, Altcoins had surged more than 100 times by the time it ended in 2022.

Traders are currently paying attention to May as a potential kickoff for the next wave of liquidity, with bettors betting a 75% chance for the Fed to hold interest rates consistently. If these odds change, traders expect money printers to follow.

Some people expect more prices to “chop” in the short term, but I pretty much agree that in most cases long term setups are becoming more and more advantageous.

“If QE really kicks off in May, this chop is gentle before Gigapump,” writes Mrbrondordefi to X.

Even if quantitative mitigation doesn’t happen immediately, confidence remains strong, as it will occur this year.

“Maybe it’s not. Then later. It’s going to happen this year. This is good for another gathering and new highs,” added Crypto Talk.

Therefore, the back will be stopped on the Fed. Whether it’s rate cut, QE, or both, the impact on crypto is enormous.

As history repeats itself and the Fed reopens its liquidity locks, Bitcoin and altcoin may be ready for historic breakouts. This could cover the benefits seen in the 2020-2021 Bull Run.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.