XRP has increased by 15.4% over the last 30 days, but has declined by 8.6% over the last four, highlighting a short-term increase in pressure. Despite monthly profits, XRP remains the third WORST-run asset of the top 20 cryptocurrencies, surpassing only BNB and TRX during this period.

Momentum indicators like RSI are trying to stabilize, but the formation of red clouds and weakening of EMA structures raise concerns. With a major resistance level overhead and the possibility of a death cross forming, XRP faces a pivotal moment in determining the next direction.

XRP RSI rebounds into neutral zone after a sudden drop

The XRP’s relative strength index (RSI) rebounded to 47.52, a sharp decline from 65.76 four days ago, and rose sharply from 35.18 yesterday after a six-day peak of the recent 74.22.

This rapid swing reflects the change in momentum after a period of strong sales pressure.

While RSI remains below the neutral threshold, the upward movement could indicate early signs of new interest or short-term relief gatherings following recent losses.

Recently, US judge Annalisa Torres rejected a joint settlement request from the SEC and Ripple, calling it procedurally inappropriate.

The XRP lawsuit will continue and the parties will now need to refill correctly or resume the appeal process.

RSI is a momentum oscillator in the 0-100 range and can help you identify conditions that are being over-bought or sold on the market.

Values above 70 usually suggest that the asset may be over-acquired and paid for corrections, while values below 30 indicate that it is being sold and may be ready for bounce.

The assets are in the neutral zone as the XRP RSI currently sits near the midpoint of 47.52. This could mean a potential move to retesting resistance levels if upward momentum is built.

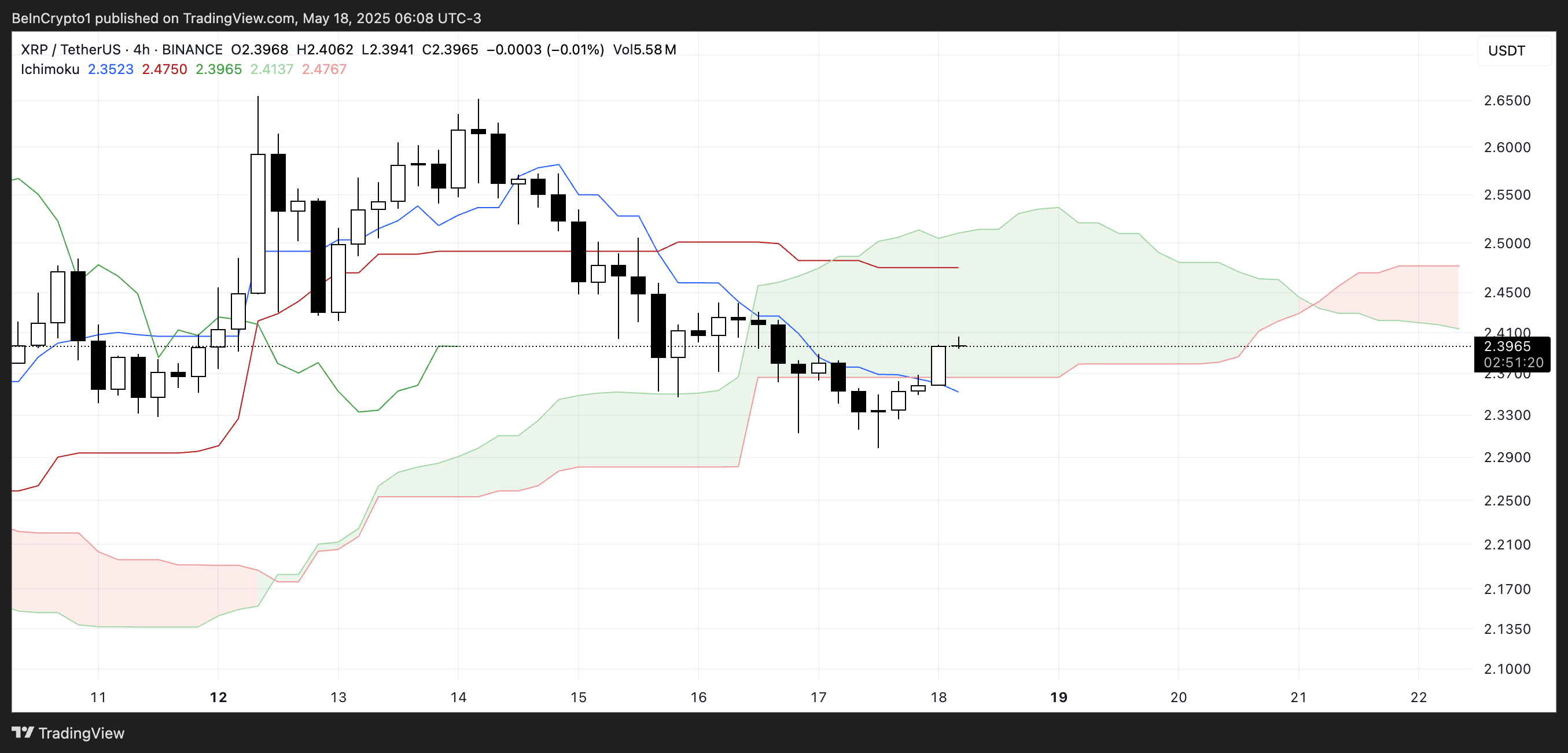

The momentum at risk is as XRP faces the formation of red clouds

XRP’s unsolved chart shows changes in the market structure. After some weakness sessions, the price tested the blue Tenkansen line.

In particular, the clouds are turning red for the first time in a few days. This is an early warning that bear pressure could rise.

The current candle is about to close on top of the Tenkan-Sen, but the wider structure faces an additional resistance, especially as prices approach the lower edge of the cloud.

The narrow gap between Redkijunsen and the price line adds to the short-term tension and strengthens the Bulls now need to step in or risk losing momentum.

The cloud’s color shift suggests that even if XRP could enter the cloud, upward traction could be limited.

If a rejection occurs then the path with minimal resistance will move downwards, creating the possibility of new modifications.

XRP approaches important resistance as EMA Deathcross threatens

The XRP EMA line shows signals ahead of troubles that could cause a sharp drop in the short-term average over the past four days.

If Emma falls short of the long term, and the current momentum doesn’t turn back, we are seeing more and more death crosses.

XRP prices are currently hovering near the key resistance zone around $2.40, with both short-term EMAs converging. A strong breakout over this area could disable a bearish setup and open the path to potential moves to $2.65.

However, it may be impossible to regain that the resistance can become vulnerable to updated downside pressures in which the XRP is.

The $2.32 level retained as support in recent sessions is important. If another retest fails, the next downside targets are around $2.15 and $2.07.

With EMAS low and resistance overhead, XRP must immediately generate significant purchase pressure to avoid further slipping.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.