XRP has recently seen an impressive rise, with Altcoin turning the USDT overturning and winning the world’s third largest cryptocurrency title. With Altcoin’s market capitalization reaching $154 billion, XRP is now half the valuation of Ethereum.

However, despite bullish sentiment, the uptrend is not strong enough, and Altcoin is now approaching the terms of acquisition. If momentum recovers, XRP can repeat the powerful price action seen in 2024.

The XRP market queue has not yet gained strength

The relative strength index (RSI) of XRP is currently located at 69.23, just below the important 70.0 threshold that indicates excessive conditions. Historically, price reversals are often seen as sluggish as assets enter the zone where they are bought. However, in November 2024, XRP ignored the typical pattern by continuing its bullish rally despite reaching similar acquisition terms.

This sets a scenario where XRP can repeat history as momentum continues. Prices did not experience a reversal in November 2024, but instead rallied sharply despite reaching the acquired territory.

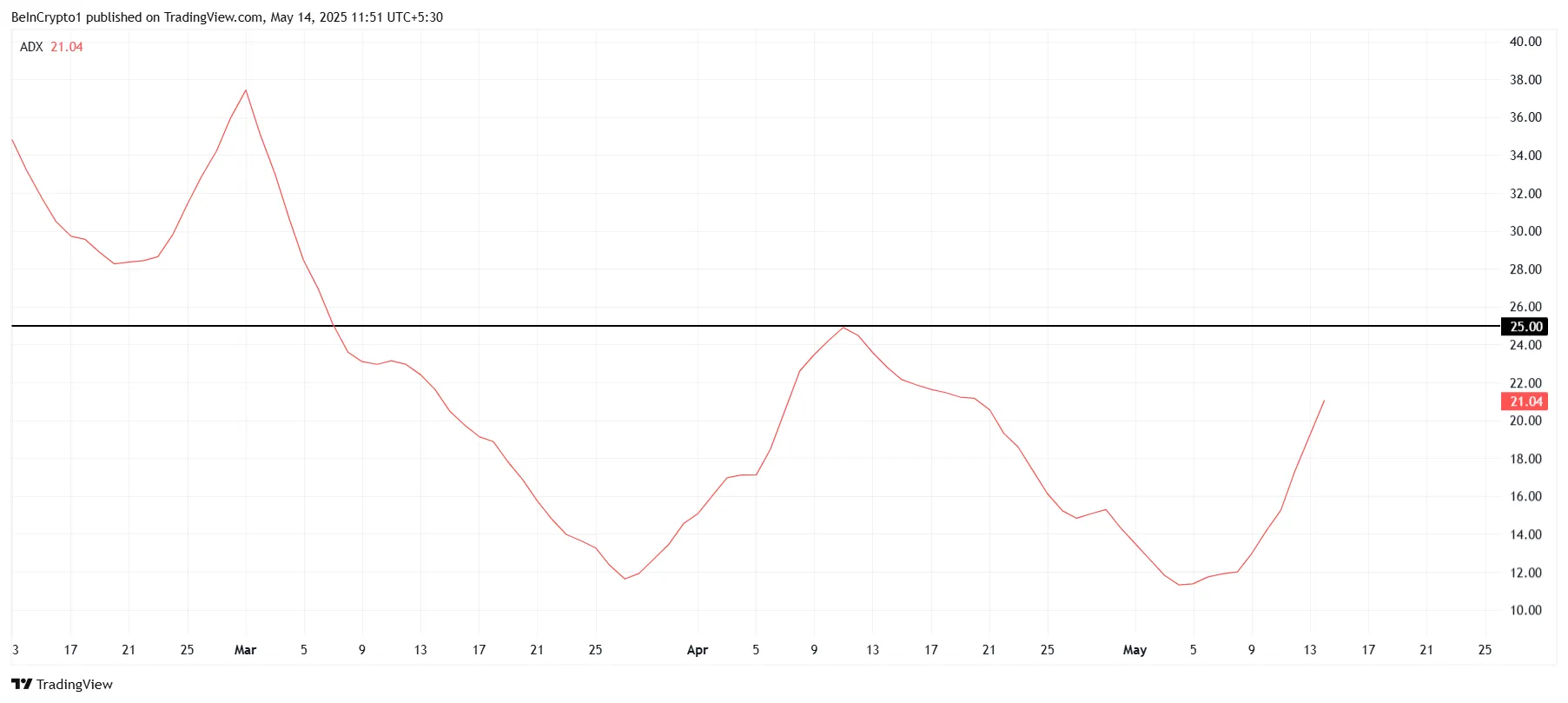

For XRP to repeat its 2024 performance, the current bullish trends must gather more powerful. The Mean Directional Index (ADX) is currently sitting just below the 25.0 threshold. This is important to check the intensity of the uptrend. If the XRP ADX exceeds this threshold, bullish momentum has gained strength, indicating that it can maintain its current rally.

In the past, when XRP experienced a similar situation in November 2024, ADX also showed an increase in momentum. This strength allowed XRP to break through resistance and push it higher, even if it was deemed to have been over-purchased. Therefore, ADX can play an important role in determining whether XRP can repeat previous successes.

XRP price is $3

XRP is currently trading at $2.58, up 21% over the past week. Altcoin was able to violate the $2.56 resistance level, but has not yet protected it as support. If this level is maintained, XRP can continue to uptrend.

XRP is currently within reach of $3.00 and aims to break the next barrier for $2.95. If XRP violates this level, a push to the $3.00 mark is possible, repeating the history of previously seen strong price movements. However, if the upward trend is not strong enough, XRP could return to the terms of acquisition and lead to a price reversal.

If an economic recession occurs, XRP could face a decline below $2.56, potentially falling to $2.27. If this occurs, it will invalidate the current bullish paper and mark the potential end of the assembly. The market’s ability to maintain strength in the short term is critical to determining the price trajectory of XRP.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.