XRP still has grown nearly 26% over the past week, trading at $2.93 after a temporary touch on $3.01. Surge rekindled bullish sentiment, but on-chain data suggests that short-term corrections may be on the horizon.

The whale trade and rising surges in exchange reserves set similar conditions to past local tops before XRP prices resume their upward journey, pointing to a 20% drop.

Notes on exchange reserve signal

XRP Exchange Reserves (Binance) has risen to the highest level (29.6 billion) since January 2025, informing us of potential sales pressures. According to Cryptoquant, the last reservation to spike this high was in May 2025, when XRP was priced at around $2.54. A 20% revision was made after that period, and the token fell to $2.01 the following week.

Typically, an increase in exchange reserve means that more tokens are being moved to exchange. Setup related to future sales. The current trend reflects what could potentially peak, increasing the likelihood that a short-term cooldown in XRP prices is coming.

Whale Transactions at 3 Months High

Supporting this paper, XRP whales have surged to the highest level in three months, with trading over $1 million. Historically, high-value transfer spikes have preceded distribution stages and price adjustments, with large holders offloading positions at the local top.

The timing of this metric coincides with Exchange Reserve Spike, adding weight to the bearish argument.

XRP price may be revised to $2.34

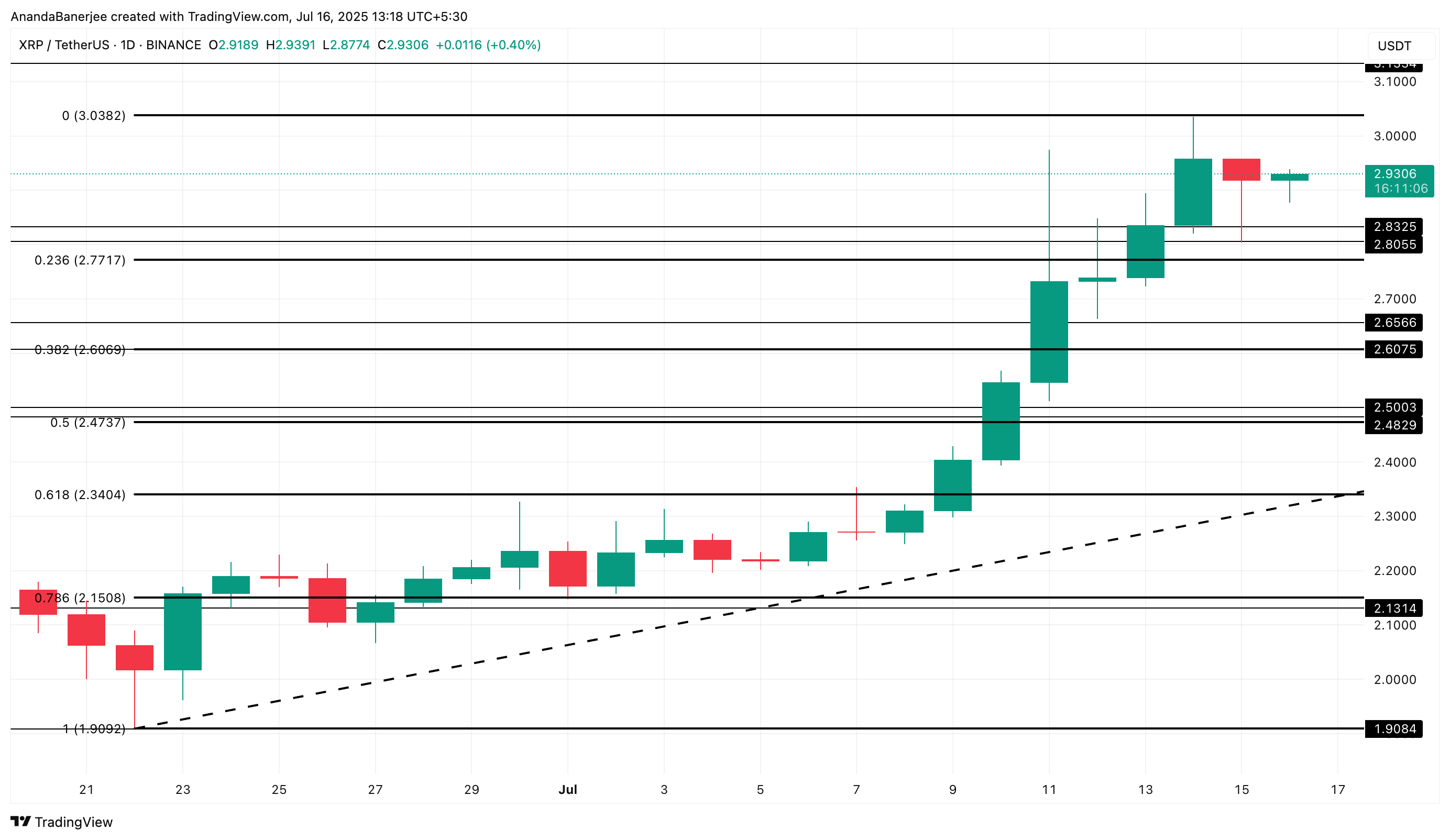

From a technical standpoint, the latest move from $1.90 (swinglow) to $3.03 (recent highs), bringing the 0.618 Fibonacci retracement level to $2.34. A critical zone that often functions as a magnet during integration or modification.

A drop of $2.93 to $2.34 from the current XRP price represents a 20% correction. This level coincides with a May decline following similar exchange reserve spikes.

Immediate short-term support is available at $2.80 (standard support line) and $2.77 (0.236 FIB level) providing scaffolding during previous pullbacks. A break below these could promote downward momentum towards a Fibonacci level of $2.34.

If your XRP is above $2.77, this bearish scenario is invalidated. This indicates that accumulations are updated rather than distributions.

If the token maintains this support and the XRP whales stop offloading, bullish momentum could resume. And it could bring XRP prices back to retesting at the $3.03 level, a key area of the ongoing XRP news cycle.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.