Despite major bullish headlines, XRP faces intense shortcoming pressures, with tokens down almost 5% in the last 24 hours and 8.5% in the past week. Multiple recent EMA death crosses have also been formed, reflecting persistent weakness.

Even with announcements like $300 million investments from Chinese AI companies and a $121 million Treasury salary increase led by Vivopower in Saudi Arabia, the technology suggests that sellers are still in good control for now.

XRP enters the territory for sale

The relative strength index (RSI) of XRP dropped significantly to 32.32 from 48.68 just a day ago.

This sudden decline reflects increased sales pressure, bringing us closer to sales thresholds without breaching XRP completely.

Interestingly, the XRP RSI has not fallen below 30 since April 7th. Recent revisions suggest that, although sharp, they do not cause the very excessive conditions seen during more serious market pullbacks.

Nearly 30 current readings show that XRP is approaching the downtrend potential fatigue station. If a buyer intervene, the price may stabilize or attempt to rebound.

That bad momentum comes after Vivopower raised $121 million for the Saudi royal-backed XRP Treasury, even after the Chinese AI company announced plans to invest up to $300 million in XRP.

RSI is a widely used momentum indicator in the range of 0-100, designed to measure the speed and magnitude of price movement. Measurements above 70 usually indicate buy conditions and potential price pull-in, but below the overselling conditions and potential price recovery for signals below 30.

The market is at a crossroads as XRP hoveres just above its overselling threshold. Furthermore, the downside could push the RSI below 30, attracting attention from tech traders who predict bounce.

At the same time, stabilization at the current level can prevent deeper losses.

Given that XRP hasn’t broken below 30 in nearly two months, a drop below that level would have attracted bargain hunters or accelerated bearish momentum if support levels were not retained.

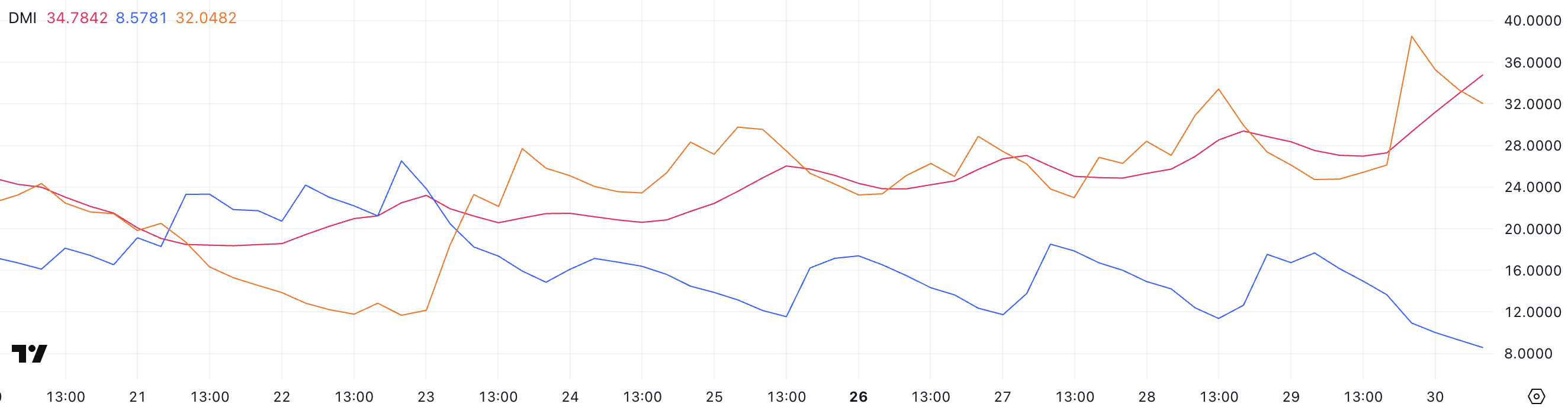

XRP DMI signals a strong bearish trend as ADX surges beyond 34

XRP’s Directional Motion Index (DMI) reveals a significant change in trend strength and momentum, with ADX rising to 34.78 from just a day ago.

ADX or mean directional index measures the intensity of a trend without indicating that direction. This suggests a strong trend for readings above 25, while those above 30 show a very strong trend.

The rapid increase in ADX confirms that the current trend is intensifying. However, the direction of that trend is revealed by the movement of the direction indicator: +DI plummeted to 8.57, while -DI jumped to 32.

This widening gap between directional indicators underscores a strong bearish trend in play. Fall +DI means bullish momentum is rapidly weakening, while rising -DI indicates sales pressure is accelerating.

-DI is currently significantly higher than +DI and the XRP appears to be firmly on the lower trends as ADX confirms the strength of this movement.

Unless the interest on purchases suddenly reversal, the current setup will strengthen what other indicators, such as RSI, are already signalling, pointing to continuous shortcoming pressures at near stages.

XRP risks below $2 if bearish momentum is built

XRP’s exponential moving average (EMA) reflects sustained downward pressure as it has recently flushed multiple death crosses and has struggled to regain traction of under $2.50.

These bearish crossovers (short-term Emma below long-term EMA) show a weaker trend, consistent with XRP’s inability to return to its recent bullish territory.

As the fixes deepen, XRP could retry support for $2.07, and if it fails to maintain that level, it will open a door below the $2 price, which is not visible after April 8th.

Still, the outlook could change as buyers regain control and XRP reverses the trend. In that case, $2.26 stands out as an important level of resistance. A successful breakout can then signal updated strength and focus on the next upward goal of $2.36, $2.47, and even $2.65.

These resistance levels must be cleared with a compelling volume to disable the current bearish EMA structure.

Until then, the crossing of multiple deaths serves as a warning that downward pressure will remain dominant unless the Bulls stage a strong recovery.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.